Topic - Physical Gold v/s Digital Gold v/s Gold ETF/Gold Mutual Fund v/s Sovereign Gold Bond (SGB)

#AkshayTritiyaSpecial #GoldInvestment #PersonalFinance

Hi 👋 , Sumit Here.

Bits And Bytes hits your Inbox every Sunday morning with notable Personal Finance and Tech related Updates to jump start your day. But Due to Akshay Tritiya its on Friday this week instead of Sunday.

Wish you all a very happy and prosperous Akshay Tritiya. Hope you will enjoy this Special coverage on GOLD investment.

Sign up below for free. 👇

Lets go ahead and get started :

Akshay Tritiya & Gold Investment History :-

Akshaya Tritiya is one of the most auspicious days for the Hindu and the Jain communities. Most people purchase gold on this day in the hopes of good luck and prosperity. This festival assumes importance since it is widely believed that the sixth incarnation of Vishnu, Lord Parshurama was born on this day.

(1) Physical Gold – Buying Gold from your friendly jeweler or bank

(a) Pros :-

(i) Tangible (You can touch it)

(ii) Buy in cash, confidentiality, difficult to trace

(iii) No maximum limit on buying

(iv) Highly Liquid

(b) Cons :-

(i) Storage/Theft

(ii) Purity (Cheating)

(iii) Making Charges (upto 35%)

(iv) Taxation vs SGB

(v) GST – 3% on selling gold

(vi) Inconsistency of pricing across sellers & spread vs traded gold

(vii) No regulator

(c) Taxation :-

(i) STCG – Less than 3 years, added to your over-all income and taxed at slab rates

(ii) LTCG – More than 3 years, 20% tax with indexation advantage

(d) Suggestion – Avoid

(2) Digital Gold – Buying from Fintech Platforms – PayTM, Google Pay, PhonePe, Safegold, MMTC, Augmont Gold, Kuvera, Upstox and Many more…

(a) Pros :-

(i) Buy as low as Re. 1

(ii) Purity – Generally wont be a problem

(iii) Storage – You don’t have to bother

(iv) Instant credit on selling

(b) Cons :-

(i) GST – 3% (You buy 1000 rupees of gold, you get 970 worth of gold)

(ii) Spread – High difference between buy and sell price (another 2-3% for storage, insurance & trustee fees)

(iii) Absence of regulator

(iv) Maximum holding period – Ex - MMTC investors will have to mandatorily take delivery or sell the gold purchased after 5 years or will have to pay extra charges, if the delivery is not taken

(v) Taxation vs SGB

(c) Taxation – Same as Physical Gold

(d) Suggestion – Avoid buying Digital Gold

(3) Gold ETF – Buying through Mutual Funds

(a) Pros :-

(i) Buying at fair value (market value, no spread)

(ii) Minimum – Rs. 50 & Maximum – No limit

(iii) Storage – You don’t have to bother

(iv) Purity

(v) No GST – indirectly (input credit)

(vi) Physical delivery not possible

(vii) Liquidity – T+1

(viii) Regulator - SEBI

(b) Cons :-

(i) Taxation vs SGB

(ii) Tracking error

(iii) Expense ratio

(c) Taxation – Same as Physical Gold

(d) Suggestion – Better than Physical & Digital gold, you can Consider it.

(4) Sovereign Gold Bond (SGB) – Buying through RBI on behalf of the central government

(a) Pros :-

(i) Issued at a discount to the current market price

(ii) Storage – You don’t have to bother

(iii) No GST

(v) 2.5% interest paid by the government, over and above the capital gains

(vi) Taxation – No capital gains tax. 2.5% interest is taxed at the slab rates

(viii) Sovereign guarantee

(b) Cons :-

(i) Not backed by physical gold purchase unlike in digital gold & ETF where gold is actually bought. But there is sovereign guarantee.

(ii) Minimum – 1 gram, Max – 4 Kgs

(iii) No physical delivery

(iv) Liquidity – Its an 8 year product. If you want to sell before 5 years, your selling price is secondary market determined which can be at a discount & there have been multiple such instances in the past.

Suggestion–If u can buy/sell from the secondary markets, this is the best product to invest in or else u have to mandatorily buy when the new issue comes & @ that price which is not always great & lock-in for 5 years. If secondary markets/timings are not your thing, consider gold ETF’s.

So from the above detailed discussion you can check and buy GOLD today and always consider the Taxation part in GOLD before investment.

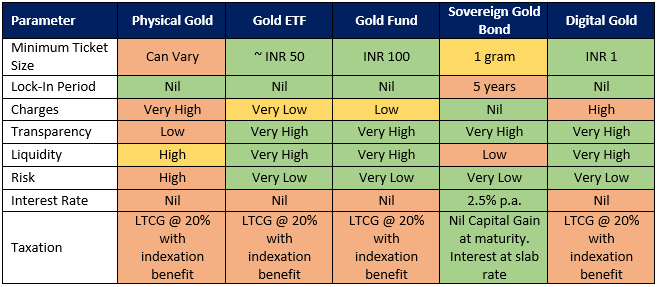

Find a Brief comparison of the above discussion as below :-

Hit that 💚 if you liked today’s issue.

You can forward this email or share FC on social media by clicking the button below. Thanks and Ciao! 😀